Each business cycle has four phases. They are expansion, peak, contraction, and trough.

An expansion is between the trough and the peak. That’s when the economy is growing. The gross domestic product, which measures economic output, is increasing. The GDP growth rate is in the healthy 2 to 3 percent range. Unemployment reaches its natural rate of 4.5 to 5 percent. Inflation is near its 2 percent target. The stock market is in a bull market. A well-managed economy can remain in the expansion phase for years. That’s called a Goldilocks economy. The expansion phase nears its end when the economy overheats. That’s when the GDP growth rate is greater than 3 percent. Inflation is greater than 2 percent and may reach the double digits. Investors are in a state of “irrational exuberance.” That’s when they create asset bubbles.

The peak is the second phase. It is the month when the expansion transitions into the contraction phase.

The third phase is a contraction. It starts at the peak and ends at the trough. Economic growth weakens. GDP growth falls below 2 percent. When it turns negative, that is what economists call a recession. Mass layoffs make headline news. The unemployment rate begins to rise. It doesn’t happen until toward the end of the contraction phase because it’s a lagging indicator. Businesses wait to hire new workers until they are sure the recession is over. Stocks enter a bear market as investors sell.

The trough is the fourth phase. That’s the month when the economy transitions from the contraction phase to the expansion phase. It’s when the economy hits bottom.

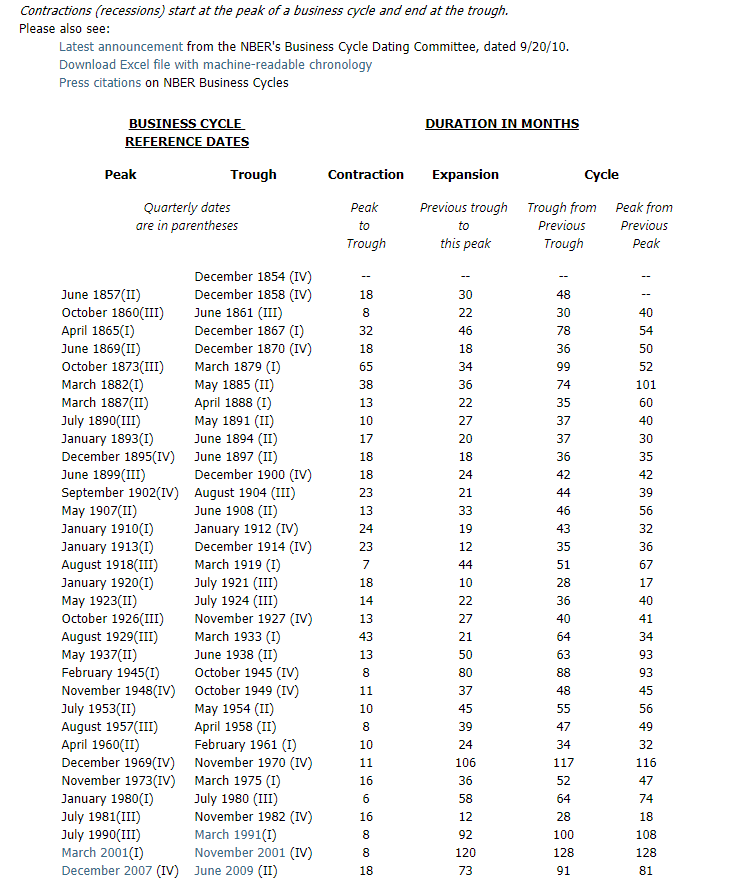

The National Bureau of Economic Research determines business cycle stages using quarterly GDP growth rates. It also uses monthly economic indicators, such as employment, real personal income, industrial production, and retail sales. It takes time to analyze this data, so the NBER doesn’t tell you the phase until after it’s begun. But you can look at the indicators yourself to determine what phase of the business cycle we are currently in.

https://www.nber.org/cycles.html

Who Manages the Business Cycle

The government manages the business cycle. Legislators use fiscal policy to influence the economy. They use expansionary fiscal policy when they want to end a recession. They should use contractionary fiscal policy to keep the economy from overheating.

The nation’s central bank uses monetary policy. It lowers interest rates to end a contraction or trough. That’s called expansionary monetary policy. The central bank raises rates to manage an expansion so it doesn’t peak. That’s contractionary monetary policy.

Expansionary monetary policy is when a central bank uses its tools to stimulate the economy. That increases the money supply, lowers interest rates, and increases aggregate demand. It boosts growth as measured by gross domestic product. It lowers the value of the currency, thereby decreasing the exchange rate. It is the opposite of contractionary monetary policy.

The goal of economic policy is to keep the economy growing at a sustainable rate. It should be strong enough to create jobs for everyone who wants one but slow enough to avoid inflation.

Three factors cause each phase of the business cycle. Those are the forces of supply and demand, the availability of capital, and consumer confidence. The most critical is confidence in the future. The economy grows when there is faith in the future and in policymakers. It does the opposite when confidence drops. The history of U.S. business cycles since 1929 can give an overview of how this measure of confidence has affected the U.S. economy through the decades.

Example

The 2008 recession was so nasty because the economy immediately contracted 2.3 percent in the first quarter of 2008. When it rebounded 2.1 percent in the second quarter, everyone thought the downturn was over. But it contracted another 2.1 percent in the third quarter, before plummeting 8.4 percent in the fourth quarter. The economy received another wallop in the first quarter of 2009 when it contracted a brutal 4.4 percent. The unemployment rate rose from 5 percent in January to 7.3 percent by December.

The trough occurred in the second quarter of 2009, according to the National Bureau of Economic Research. GDP contracted 0.6 percent. Unemployment rose to 9.5 percent.

The expansion phase started in the third quarter of 2009 when GDP rose 1.5 percent. That was thanks to the stimulus spending from the American Recovery and Reinvestment Act. The unemployment rate continued to worsen, reaching 10 percent in October. Four years into the expansion phase, the unemployment rate was still above 7 percent. That’s because the contraction phase was so harsh.

The peak that preceded the 2008 recession occurred in the third quarter of 2007. GDP growth was 2.2 percent.