-Spin-off, Partial Spin-offs, and Rights offering.

-Chapter 11 and restructuring companies.

-Merger and Acquired companies.

Magic Formula Investing <Screener> CLICK!!

PROFITABILITY

ROIC (Return on Capital) Highest

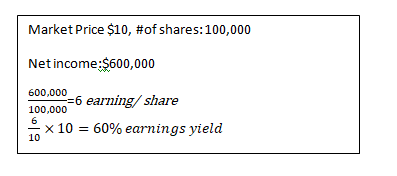

Earnings Yield (Inverse of PE)- The Higher, The Better.

EBIT/ Enterprise Value

Own 20-30 Magic Formula stocks at the time to be close with the average (30%), or (five to eight stocks in different industries can safely make up at least 80 percent of your total portfolio) and holding for one year, and then re-running the process annually. These stocks should be held for a period of three to five years.

-

Out of 3,500 companies, Rank 1-3,500 by Highest ROC

-

Out of 3,500 companies, Rank 1-3,500 based on earnings yield

-

Look for the companies that have the best combination of both

Ex. Rank 56nd rank in ROC and 34th rank in Earnings Yield (56+34)

-

Buy top 30 stocks below average prices

Businesses with high returns on capital tend to attract competition.

During those wonderful 17 years for the magic formula, there were even some periods when the formula did worse than the overall market for three years in a row! “I know I just lost a lot of money,” but “Let’s keep doing what we’re doing!

Graham figured that the purchases made by using his formula would be bargains—bargains created by Mr. Market practically giving away businesses at unreasonably low prices.

What do you think would happen if we simply decided to buy shares in companies that had both a high earnings yield and a high return on capital? “The profits would be quite satisfactory!”

Ideally, better than blindly plugging in last year’s earnings to the formula, we should be plugging in estimates for earnings in a normal year.* *A normal year is one in which nothing extraordinary or unusual is happening within the company, its industry, or the overall economy.

How confident?

We could then compare the earnings yield based on normal earnings to a risk-free 6 percent government bond and to our other investment opportunities.

For individual stocks in which we are showing a loss from our initial purchase price, we will want to sell a few days before our one-year holding period is up. In that way, all of our gains will receive the advantages of the lower tax rate afforded to long-term capital gains (a maximum 15 percent tax rate under federal guidelines for stocks held more than one year), and all of our losses will receive short-term tax treatment (a deduction against other sources of income that otherwise could have been taxable at rates up to 35 percent).

We probably don’t want to buy all 30 stocks at once. To reproduce the results from our tests, we will have to work into our magic formula portfolio over the course of our first year of investing. That means adding 5 to 7 stocks to our portfolio every few months until we reach 20 or 30 stocks in our portfolio. Thereafter, as stocks in our portfolio reach the one-year holding mark, we will replace only the 5 to 7 stocks that have been held for one year.

Sell each stock after holding it for one year. For taxable accounts, sell winners after holding them a few days more than one year and sell losers after holding them a few days less than one year

General Screening before Magic formula

Magic Formula Investing <Screener>

- Use Return on Assets (ROA) as a screening criterion. Set the minimum ROA at 25%. (This will take the place of return on capital from the magic formula study.)

- From the resulting group of high ROA stocks, screen for those stocks with the lowest Price/Earning (P/E) ratios. (This will take the place of earnings yield from the magic formula study.)

- Eliminate all utilities and financial stocks (i.e., mutual funds, banks and insurance companies) from the list.

- Eliminate all foreign companies from the list. In most cases, these will have the suffix “ADR” (for “American Depository Receipt”) after the name of the stock.

- If a stock has a very low P/E ratio, say 5 or less, that may indicate that the previous year or the data being used are unusual in some way. You may want to eliminate these stocks from your list. You may also want to eliminate any company that has announced earnings in the last week. (This should help minimize the incidence of incorrect or untimely data.)

- After obtaining your list, follow steps 4 and 8 from the magicformulainvesting.com instruction page.

(market caps over $1 billion) the results for the magic formula remain incredibly robust.

For larger stocks, it didn’t really work. For the largest one-third of stocks by market capitalization,* the highest-ranked stocks on Piotroski’s nine-point scale did not significantly outperform the average low price/book stock.† This is not surprising, either. As already mentioned, it’s just easier to find mispriced stocks among smaller- and mid-capitalization issues.