Law of Vibration enabled me to accurately determine the exact points to which stocks or commodities should rise and fall within a given time.

The working out of this law determines the cause and predicts the effect long before the Street is aware of either. Most speculators can testify to the fact that it is looking at the effect and ignoring the cause that has produced their losses.

Law of Vibration is the fundamental law upon which wireless telegraphy, wireless

telephones and phonographs are based. Without the existence of this law the above inventions would have been impossible.

The law which I have applied will not only give these long cycles or swings, but the daily and

even hourly movements of stocks. By knowing the exact vibration of each individual stock I am able to determine at what point each will receive support and at what point the greatest resistance is to be met. "Those in close touch with the markets have noticed the

phenomena of ebb and flow,12 or rise and fall in the value of stocks.

At certain times a stock will become intensely active, large transactions being made in it; at other times this same stock will become practically stationary or inactive with a very small volume of sales. I have found that the Law of Vibration governs and controls these conditions. I have also found that certain phases of this law govern the rise in a stock and

an entirely different rule operates on the decline.

"I have found that in the stock itself exists its harmonic or inharmonic relationship to the driving power or force behind it.13 The secret of all its activity is therefore apparent. By my method I can determine the vibration of each stock and by also taking certain time

values into consideration I can in the majority of cases tell exactly what the stock will do under given conditions.

"The power to determine the trend of the market is due to my knowledge of the characteristics of each individual stock and a certain grouping of different stocks under their proper rates of vibration. Stocks are like electrons, atoms, and molecules, which hold persistently to their own individuality in response to the fundamental Law of Vibration.

"From my extensive investigations, studies and applied tests, I find that not only do the various stocks vibrate, but that the driving forces controlling the stocks are also in a state of vibration. These vibratory forces can only be known by the movements they generate on the stocks and their values in the market. Since all great swings or movements of the market are cyclic they act in accordance with periodic law.

I affirm, every class of phenomena, whether in nature or in the stock market, must be subject to the universal law of causation and harmony. Every effect must have an adequate cause.

"If we wish to avert failure in speculation we must deal with causes. Everything in existence is based on exact proportion and perfect relationship. There is no chance in nature, because mathematical principles of the highest order lie at the foundation of all things.

Faraday said: 'There is nothing in the Universe but mathematical points of force.

"Vibration is fundamental; nothing is exempt from this law; it is universal, therefore applicable to every class of phenomena on the globe.

"Through the Law of Vibration every stock in the market moves in its own distinctive sphere of activities, as to intensity, volume and direction; all the essential qualities of its evolution are characterized in its own rate of vibration. Stocks, like atoms, are really centers of

energies, therefore they are controlled mathematically. Stocks create their own field of action and power; power to attract and repel, which principle explains why certain stocks at times lead the market and 'turn dead' at other times. Thus to speculate scientifically it is absolutely necessary to follow natural law.

"In order to test my idea, I have not only put in years of labor in a regular way, but I spent nine months working night and day in the old Astor Library and in the British Museum, in London, poring over ancient books on mathematics and geometry, as well as the records of stock transactions as far back as 1820. I have, incidentally, examined the manipulations of Jay Gould, Daniel Drew, Commodore Vanderbilt, and all other important Wall street manipulators from that time to the present time.

85 PER CENT CORRECT

His daily Supply and Demand letter gives to his clients scientific forecasts on stocks, cotton and grain. And the clients who have followed his advice for twenty years testify that eighty-five per cent of his predictions are correct.

"I figure things by mathematics," Mr. Gann explained. "There is nothing mysterious about any of my predictions. If I have the data I can use algebra and geometry and tell exactly by the theory of cycles when a certain thing is going to occur again."

"If we wish to avert failure in speculation we must deal with causes. Everything in existence is based on exact proportion and perfect relationship. There is no chance in nature, because mathematical principles of the highest order lie at the foundation of all things. Faraday said: – 'There is nothing in the universe but mathematical points of force."

The Predictive Power of Numbers

In his course “Master Charts,” Gann states emphatically:

"... numbers do determine everything in the future ..."46 Once again, we find Gann to be following the teachings of the ancients:

Ages long ago men reckoned the cycles of nature by numbers, and numbers became symbols of natural law and of spiritual ideals manifested in nature.47 That events move in cycles and are ruled by numbers, was once firmly believed in the old days of astrologers.

Harmonics

Harmonics is an area of Gann study to which he refers by name rarely. He speaks of it in the Ticker Interview and in his novel The Tunnel Thru the Air. In the Ticker Interview, Gann says: I have found that in the stock itself exists its harmonic or inharmonic relationship to the driving power or force behind it. The secret of all its activity is therefore apparent. … Everything in existence is based on exact proportion and perfect relationship. There is no

chance in nature, because mathematical principles of the highest order lie at the foundation of all things.

Gann adds, in The Tunnel Thru the Air:

...the cycle theory, or harmonic analysis, is the only thing that we can rely upon to ascertain the future.

Gann, in a comment in a brief essay of his, echoes this view: "... anything that can be proved in any way or by any science is not correct unless it can be proved by numbers and by geometry."

In The Tunnel Thru the Air, which is the only place in his writings that Gann revisits the story of Harriman, the hero Robert Gordon asks "an old man by the name of Henry Watson who was a veteran of Wall Street, now over 70 years of age," about how to be successful in the markets.

“Has any man ever made a large fortune out of Wall Street and kept it, Mr. Watson?” “Oh, yes,” he replied, “if there were not exceptions to the rule, business would not continue to run. I could tell you of dozens of them, but one striking example is that of the late E. H. Harriman who died worth about three hundred million dollars. He had probably made out of the market a hundred million dollars in the last three or four years of his life.” Robert asked, “How did he do it?” Mr.

Watson answered, “He stuck to one class of stocks – railroads. He studied them day and night, never diverted his attention to other lines. I believe that he possessed some mathematical method65 which enabled him to forecast stocks many months and years in advance. I have gone over his manipulations and the stocks he traded in, and found that they conform closely to the law of harmonic analysis. He certainly knew something about time and season because he bought at the right time and sold at the right time.

Stock Market Course

Be ready for opportunities. Knowledge more important than capital. To succeed in any business you must be prepared, and in preparing for a speculative or investment business you must look up the greatest advance or the greatest decline a stock has ever had and the greatest time period from the high or low. Most profits are made in active fast moving markets.

Examples: Stocks

1924-1929 – September 29th to November 15th, 1929; November 13, 1929 to April 17, 1930.

SLOW TRADING MARKET

You should keep out of slow trading markets or watch until you get a definite indication of a change in trend. There was a slow trading market from November 1946 to November 1949, that is the range in most stock was narrow because the market was going through a period of consolidation or accumulation and getting ready for the big bull market which followed later.

HOW TO SELECT THE GROUP OF STOCKS WHICH WILL LEAD AN ADVANCE OR A DECLINE

During 1953– 1954 the Aircrafts were big leaders.

You can see from the chart and the group of the averages on Aircrafts where they broke into new high levels. Example: Douglass Aircraft, Boeing Aircraft, United, Glenn Martin and Lockheed all indicated that they were in a position to advance when the average price or average value of the group of stocks indicated a strong position. Without a knowledge of these things you could not make a success.

LOW PRICE STOCKS DISAPPOINTING

A study of past history proves that buying low price stocks often ties up capital for a long period of time. You wait, and if you do not lose money you lose your patience and when your patience is exhausted in advance of the start you get out. Many low price stocks have held in narrow trading for 5, 10 years or more before they started to advance or to decline and some, after remaining in a narrow trading range for a long period of time, declined to new low levels. The

best way to make money is to take higher price stocks and buy them after they have broken into new high ground and show activity as outlined under the rules below.

- NEW INDUSTRIES AND GROWTH STOCKS

- STOCKS OF THE FUTURE

HOW TO MAKE SPECULATION A PROFITABLE PROFESSION

Speculation or investment is the best business in the world if you make a business of it. But in order to make a success of it you must study and be prepared and not guess, follow inside information or depend on hope or fear. If you do you will fail. Your success depends on knowing the right kind of rules and following them.

THE KIND OF CHARTS TO KEEP

Remember the old Chinese proverb, “One good picture is worth 10,000 words”. You should make up charts and study the picture of a stock before you make a trade. You should have a weekly high and low chart, a monthly high and low chart, and a yearly high and low chart. A yearly high and low chart should run back 5, 10, or 20 years, if you can get records that far. Monthly high and low chart should run back for at least 10 years and the weekly high and low chart should run back for 2 or 3 years. When stocks are very active you should have a daily high and low chart. This need not go back more than a few months, especially start the daily chart after the stock breaks into great activity.

PROVE ALL THINGS AND HOLD FAST TO THAT WHICH IS GOOD

The Bible tells us this and it is well worth remembering. Many people believe that it is wrong to buy at new high levels or sell at new low levels but it is most profitable and you must prove this to yourself because when you do buy at new high levels or sell at new low levels you are going with the trend of the market and your chances for making profits are much better than any guesswork or buying or selling on hope or fear.

THE BEST BUYING POINT

This point is when prices decline to 50% of the highest price at which a stock has ever sold; the next strongest and best buying price is 50% between the extreme low and the extreme high (See example on Chrysler Motors.)

SELLING LEVEL:When prices advance after they have been considerably below the 50% point and advance for the FIRST TIME, it is a selling level and a price to sell short, protected with STOP LOSS orders 3 points above the 50% level. The first time a stock reaches these levels, if the indications on the daily chart and the weekly chart show it is making tops, you should sell out long stocks and sell short.

The next important selling level is 50% between the extreme low and the

extreme high.

CHRYSLER MOTORS:(Example of 50% Price)

1946, February high 141½, divide by two and get 50% of the highest selling price. This gives 70-3/4. After Chrysler was split up and sold ex-stock dividend in 1947, it declined to 44 in June 1949; from this level, which was a buying point, the trend started up.

1953, January high 98½; we always expect selling just under 100 and Chrysler made top at this level. We figure the range being 44 and 98½ which gives a 50% price at 71¼.

1953, June Chrysler low 70, just below the 50% price. It rallied to 73 in August which was a very feeble rally and closed at 71 indicating lower and was a short

sale.

1932, Chrysler extreme low $5 per share; 1953 high 141½. 50% of these extremes is 73¼ when Chrysler can advance and close above 73¼ it will indicate higher prices.

1954, February Chrysler declined to 57 and has shown very little rallying power. At the time of this writing the main trend is down and when it closes below 57 it will indicate lower. The next price to watch is the old low of 44 made in June 1949.

Look up the extreme highs and low and figure all other stocks in the same way to get buying and selling points and resistance levels. When you start trading be sure that you know all of the rules and that you follow them, and be sure that you place a STOP LOSS order.

WHERE TO PLACE STOP LOSS ORDERS

STOP LOSS orders should e place below closing prices on the daily, weekly or monthly chart.

For stocks selling around $10 a STOP LOSS order is usually safe if you place it 1-point below closing price.

For stocks selling between 20 and 30, STOPS should be placed 2 points below bottoms or below closing prices.

Stocks selling between 90 and 150; in this range of prices STOPS should be 3 points under the lows or closing prices, and 3 points above the high or low closing prices.

WHAT TO DO BEFORE YOU MAKE A TRADE

Check all records of prices, daily, weekly, monthly and yearly and note all time periods. Note when the prices are near some old high levels or near some old low levels of recent weeks or years. Then calculate just what you risk will be before you make the trade and after you make it, place the STOP LOSS order for your protection in case you are wrong.

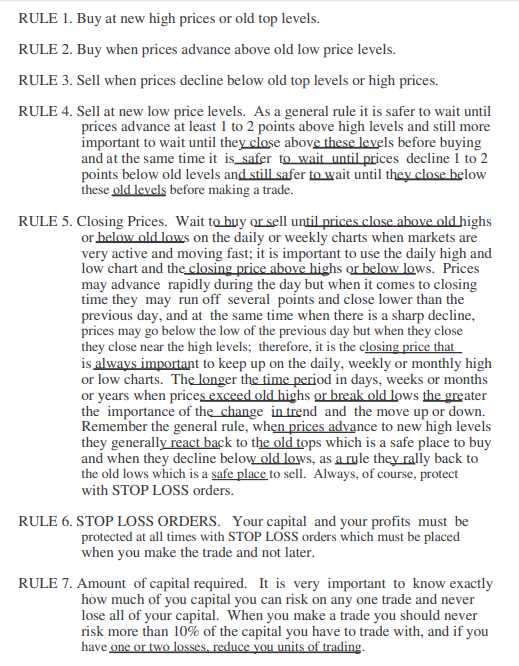

RULES FOR STOCKS

A. How Much Decline To Expect In A Bull Market And How Much Rally To Expect In A Bear Market.

After a bull market gets under way and stocks are moving up fast, the reactions are likely to be quick and sharp but they will never last more than 3 to 4 weeks as a general rule and then the upward trend will be resumed, so you can always figure that stocks are a buy on a reaction of about 1 month in a bull market.

In a bear market after the main trend has been established downward, the rallies will run three weeks to four weeks and seldom ever more than one month, but in some cases after sharp, severe declines in a short period of time rallies will last as much as 2 months.

B. How To Make The Most Money In The Shortest Period of Time.

People want to get rich quick, that is why they lose their money because they try to get rich quick with out first preparing themselves for getting ready or having the knowledge to know how and when to make the most money in the shortest period of time. I am going to prove to you, by examples, and you can also prove to yourself, when you can make the most money in the shortest period of time. Do not try to lead the market or make the market.

Follow the big men with big money and you will make big money. Buy when the big market makers are ready for prices to move up fast and you will make the most money in a short period of time. Sell when the big market money makers have distributed stocks and are ready for them to go down and there is indication of definite trend downward. Then sell short and

you will make the most money in the shortest period of time.

It requires time for a market to get ready, time for stocks to be absorbed or accumulated but once we have passed from weak into strong hands, then they move up fast because the offerings are smaller and the big people just have to let the market roll and do a little buying and it goes up easy.

It also requires a long period of time to sell out stocks or distribute them once they have reached the high levels and let the stocks pass from strong hands into weak hands. When this period is over and the market is ready, then it declines fast and if you trade this way and wait until there is a definite indication that the trend has changed, you really can make the most money in the shortest period of time.